property tax in nice france

The interest rate on new home loans remained at a low of 112 in November after being at 113 in. The total taxes paid during the house purchase in France may add up 20 to the property price.

Taxes In France A Complete Guide For Expats Expatica

Registration fees or notary fees.

. Tuesday 26 October 2021. The basis of tax is the price if the real estate is transferred against payment and the market value in other cases. The total taxes and fees will depend on the type of property you decide to purchase.

The French taxe foncière is an annual property ownership tax which is payable in October every year. These costs which are mainly for the public treasury are calculated according to the type of property its location and characteristics and your method of financing. For property tax on the earnings from the sale of properties in France rates are set to 19 for all EU citizens and 3333 otherwise.

Each autumn the local rates bill for the year drops into the mailbox of property owners. Once youve purchased a property youll more than likely need to start paying taxes in France. Property Tax in France Land TaxTaxe foncière.

Lets say that you purchase an old property. Email your questions to editors. When purchasing a property more than five years old there are three separate taxes payable with a maximum tax payable of just under 9 per cent.

The liability for the tax foncière lies by the owner of the property. In total these taxes amount to just over 20 per cent of the value of the property see Buying a new build in France. These include a departmental tax usually 45 of the purchase price as well as a communal tax at the rate of 120 and another government charge of 237.

There are 2 types of property taxes in France the taxe dhabition and the taxe foncière. The two property taxes in France are the taxe foncière and the taxe dhabitation although the latter is gradually being phased out by 2020 for most households. A homebuyer can expect to pay about 7 of the purchase price of an existing property in taxes and fees such as stamp duty notary fees and transfer taxes he said.

As the bill is a significant one most households opt for monthly payments over the year. No matter if you own or rent the place as a resident or not this tax will apply. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property.

For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. The main two taxes in France for property are the t axe foncière and the taxe dhabitation. For properties less than 5 years old stamp duty is 07 plus VAT at 20.

Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary residence. Anyone who lives in France pays the tax dhabitation. The production of housing loans reached 231 billion in November 2021 181 billion excluding renegotiations after 243 billion in October 195 billion excluding renegotiations.

An additional fee of 01 and a notary fee that is about 15-2 is added to the result. - registration fees also called the notary fees around 75 of the purchase price. The Taxe Foncière is payable by property owners whether they live in the property or not.

In the case of the purchase of an old property the total transfer of ownership costs and taxes payable for the purchase of an existing property is between 7 and 10 of the purchase price excluding real estate agency fees. Here is how it is calculated. There is no exemption.

Taxe Foncière 2021. In France there are two main property taxes payable for new build purchases. Registration fees and taxes calculation is based on principally the real estate location and vary from 509006 to 580665 depending on the property location departmental fees.

The rate is 509 580 for real estate located in France variable according to where it is located and 5 for real. The total fees and taxes payable will depend on the type of property you purchase. This needs consideration whether its a permanent home or a second home.

Credit - Banque de France data - Figures at end of november 2021. In France there are two property taxes to pay Taxe dHabitation and Taxe Foncière both are forms of a council tax. Taxe dhabitation is a residence tax.

They include agents fees 5-8 notary fees 25-5 stamp duty 58 and registration cost 1-3. The taxe foncière is used to fund. On average for the purchase of an older property the transfer costs amount to 75 of the sale price whereas for a new property the transfer costs are 3.

As a French property owner you must pay these French property taxes whether you are a permanent resident or use the property as a second home or holiday home. Together these taxes are the equivalent to UK Council Tax. The Taxe dHabitation is payable by the residents of.

French taxes. You have to pay this tax if you own a property and live in it yourself have it available for your use or rent it out on. Any owner of real estate in France on 1 st January of the taxation year must pay the property tax during the last quarter of the same year after receipt of his tax.

French property tax for dummies. Any person living abroad and owner of real estate in France is subject to French property tax. Buying property in France you pay.

French notary fees are varying from 5 for the first 3000 and then gradually down to 03 if your purchase exceeds 120000. It is payable by the individual who owns the property on the 1st January of the same year and is applicable whether you live in your property or rent it out. Last month the French tax authority sent out to all home-owners their annual taxe foncière rates bill.

For properties more than 5 years old stamp duty is 58 or 509 in some departments. - pro rata land tax the seller pays this annual tax but you repay the notary the amount for the current year calculated from the day of completion.

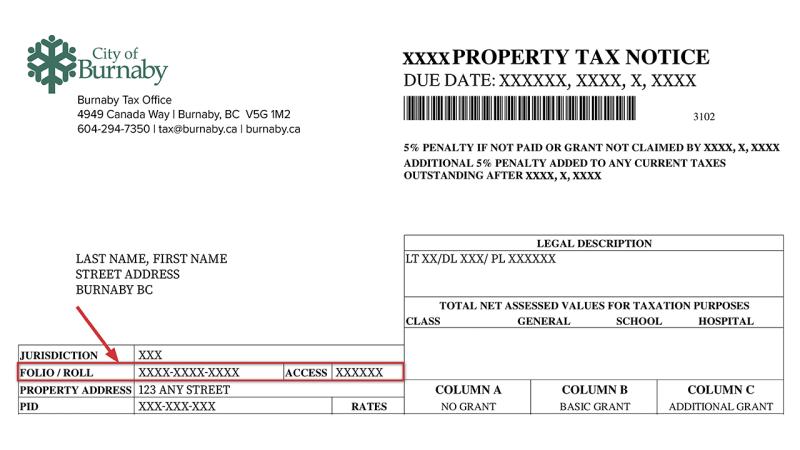

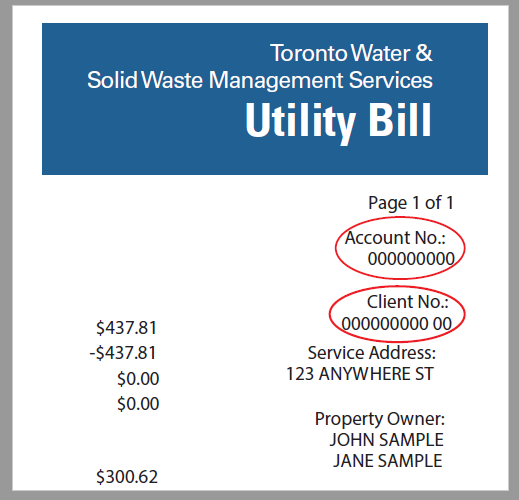

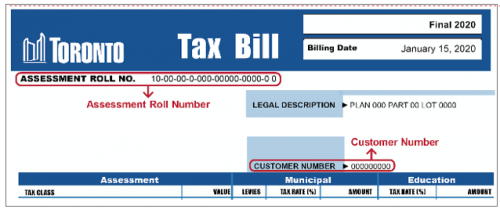

Buying Selling Or Moving City Of Toronto

Assessor Property Tax Data Scraping Services

As With A Property In The Uk If You Sell A Property In France For More Than You Paid For It You Are Potentially Capital Gains Tax Capital Gain Property France

10 Us Cities With Highest Property Taxes

Find Out Whether A Planning Permission Or Works Declaration Is Required When Building In France Buying Property In France Property France France

Income From Property Tax Rates In Pakistan 2021 22 In 2022 Property Family House Separating Rooms

French Property Buying Property In France Property

Taxes In France A Complete Guide For Expats Expatica

Taxes In France A Complete Guide For Expats Expatica

Cypress Texas Property Taxes What You Need To Know

Property Taxes Property Tax Analysis Tax Foundation

Property Taxes Property Tax Analysis Tax Foundation

Property Taxes Property Tax Analysis Tax Foundation

Pin On Technology Logos Design

Tax And Utilities Answers City Of Toronto